Depreciation Schedules

Depreciation Schedules in Sydney for property

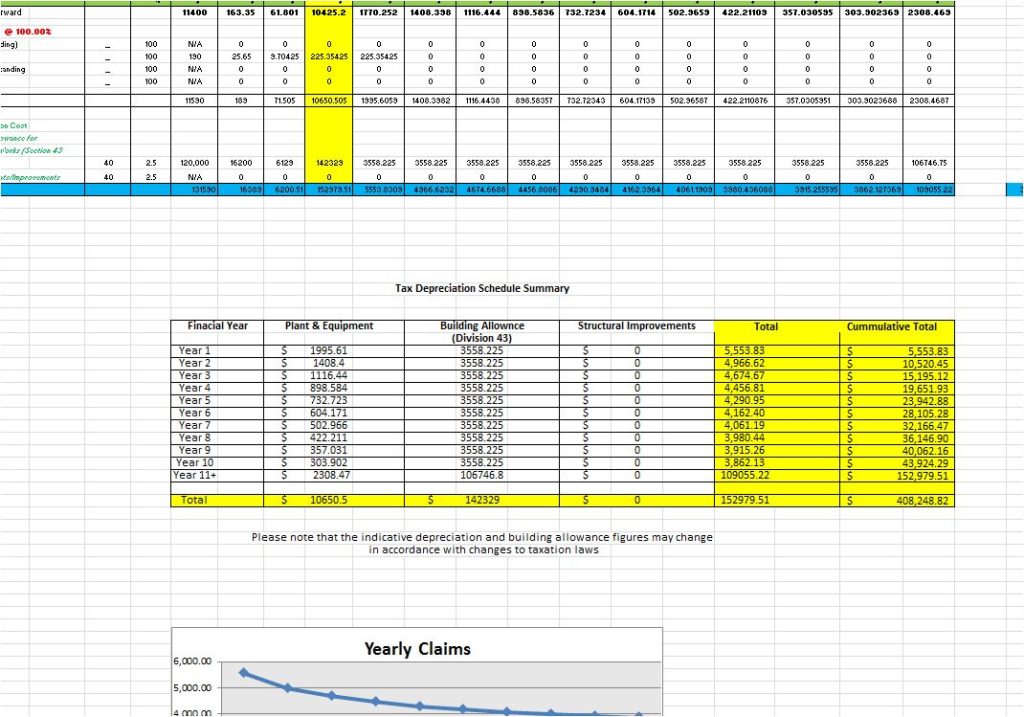

A depreciation Schedule is prepared by a specialist valuer experienced in depreciation. When we prepare a tax depreciation schedule, two main elements are generally included which are:

Capital works deduction (division 43) and

Plant and equipment (division 40)

We provide a ten year schedule which your accountant can reply on for taxation purposes.

Its important to know the date the home was built.A full inspection of the property is required and photographs taken of relevant items for depreciation.

Sample Depreciation Schedule Report in Sydney for property