Our Valuation Services

Depreciation Schedules

Depreciation Schedules in Sydney for property A depreciation Schedule is prepared by a specialist valuer experienced...

Easement Valuations

We specialise in easement valuation. Easement valuations are a specialised area of property valuation. Michel Hermiz is one of our...

Development Site Valuations

A development site valuation can be an important document for making significant financial decisions. We have extensive experience in development...

Specialized Valuations

Learn more about all of our specialized valuation services which can service your business. Capital Gains Tax Valuations Commercial Property...

Residential Valuations

Residential valuations are the most common types of property we value. We have an Australia wide network of residential valuers...

Rent Review Valuations

We undertake rental reviews and also rental determinations for commercial, industrial and retail property. We meet the requirement of specialist...

Industrial Property Valuations

Our industrial valuers value industrial property for a variety of clients and purposes. Feel free to contact us, our industrial...

Compensation and Resumption Valuation

Our expert compuslory acquisition valuers provide consultancy for dispossessed owners. Anderson's have undertaken many resumption matters and provided expert evidence...

Commercial Property Valuations

Our commercial valuers value, office space, office buildings, shops, mixed use commercial centres, mixed use developments, and other types of...

Deceased Estate and Probate Estate Valuations

A probate valuation also known as deceased estate valuation is one of the documents an experienced executor will obtain as...

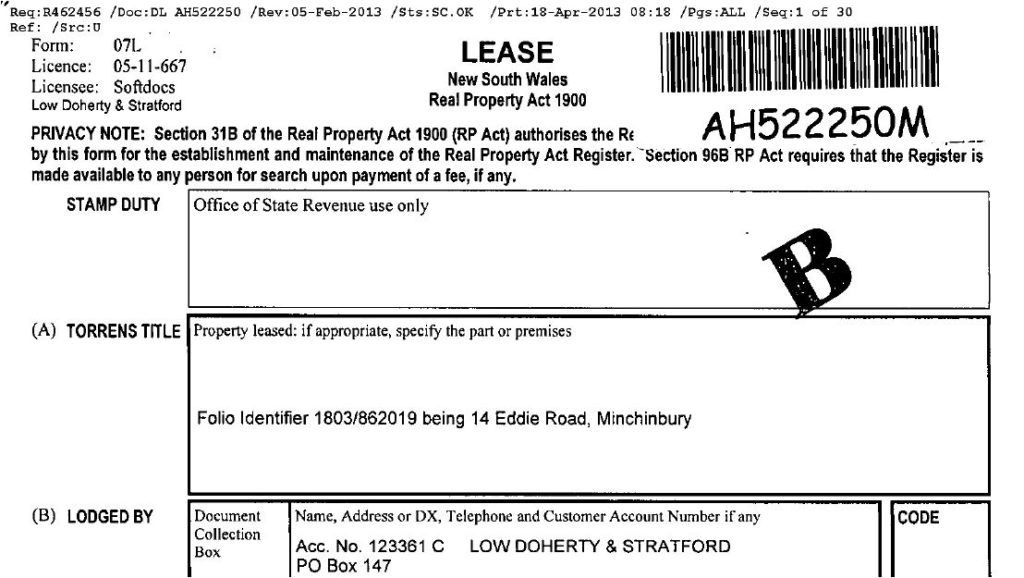

Stamp Duty Valuations

We have been providing stamp duty valuations for the office of state revenue for many years. A stamp duty valuation...

Compensation Valuations

We have extensive experience in providing comprehensive compensation valuation and consultancy services in regards to compensation valuation under the provisions...

Capital Gains Tax Valuations

For the right capital gains tax valuation for your property you have come to a company who specializes in this...

Family Law Court Property Valuers

Hello to our solicitors who have been using our services for many years and new visitors to our site. We...